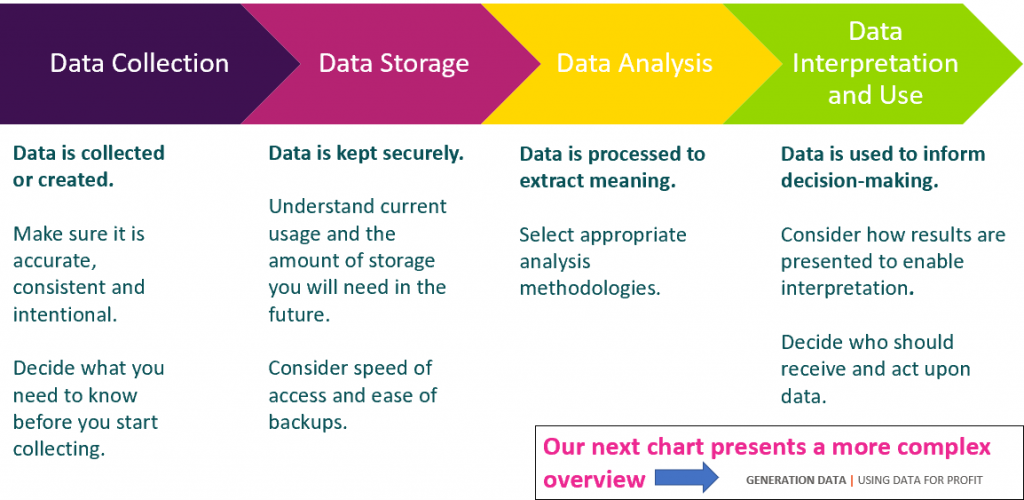

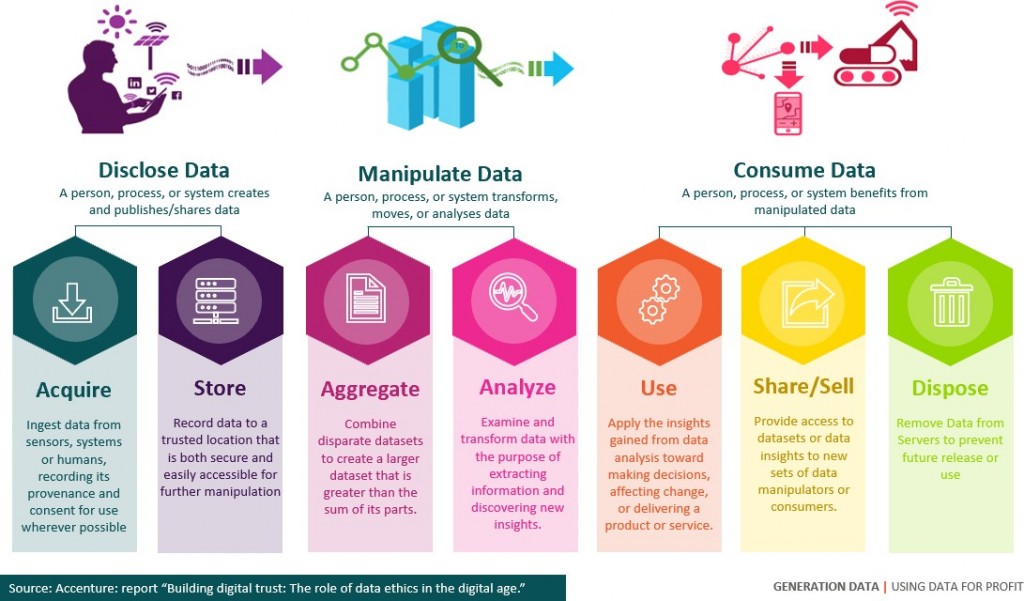

1. The Data Value Chain – a clear overview of the value chain

“This really worries me because you seem to know more about my business in three months than I’ve learned in 30 years.”

Lord Ian MacLaurin, Chairman

Tesco Clubcard- START WITH A STORY

EXPOSITION

In early 1990s Tesco was second in the UK supermarket share to Sainsburys. Like any enormous retailer, they had LOTS of data from transactions but no way to personalize it. Just information about which products selling for how much and where. This was great for understanding trends retroactively but not as useful for growing the business, increasing customer spend and loyalty.

In 1995 they launched the Tesco Clubcard. Clubcard holders could collect points (1 point for each pound spent) and received vouchers to their home with magazine every 3 months. They thought that a sales uplift of 1.6% would cover the 10 million pounds cost of launching the card and the reward vouchers. The month after the launch they overtook Sainsburys and stayed ahead for decades. The uplift was around 4% at peak then settling at 2%.

It looks like the success was based on increasing customers’ motivation to return to the store because of they would earn vouchers. However, a programme with millions of members generates a tremendous amount of data. Tesco worked with Dunnhumby, a marketing analysis company, to process the data. After the first trial run, in fact, when they presented their findings and case for further roll out to the board, Tesco’s chairman, Lord Ian MacLaurin, famously said,“Well, this really worries me because you seem to know more about my business in three months than I’ve learned in 30 years.”

In Sept 2002 Tesco rolled out targeted electronic coupons at the checkout – automatically printed at tills at time of purchase but not like competitors, not triggered by purchase of a certain item, but by the customers own recent purchase history. Out of 100 – 200 offers, the system selected those relevant to that customer.

In Nov 2002 added an online clubcard – as reward points converted to ecoupons to be redeemed online, all of the then 10 million customers were being encouraged to log in online. Company made use of the data by targeting customers with mailshots highlighting different offers and advantages to well segmented groups based on known spending and shopping habits.

(Note: because Dunnhummy was so successful with Clubcardand its associated customer analytics, Tesco actually bought the business, in the process making multi-millionaires of its founders.)

INTERPRETATION

Tesco is considered prime example of successful customer loyalty scheme using big data. Albeit, due to fierce competition they have seen a drop in profits in last 8 years. Why did this case make such an impact?

As a “normal” retailer, they had huge amounts of data from transactions but no way to make real use of it. By introducing clubcard, they immediately got hugely more enriched customer data: who you were, where you lived, where you shopped, when you shopped, how much you spent and which departments you shopped in. Later on, Clubcard put buying habits with a name (and a face) and an email address. So what started as a hope for a loyalty effect, opened the door to a direct marketing channel to consumers, which enabled them to access unparalleled flows of data and run the business better. “It was the first time a mass retailer could talk to individual customers on a personal level.” Tim Mason, who became Tesco’s board-level marketing director in 1995.

You can’t manage what you don’t measure.

Edwards Deming and Peter Drucker